“What happens if China sells all of its U.S. Treasury holdings?”

What happens when China sells all holdings of its U.S. treasuries?

Recently, I attended a conference in my field where a panel of experts was featured. During the Q&A segment, a question was raised about the potential impact of China divesting its entire portfolio of U.S. treasury bonds. The analysts on the panel discussed the likely market challenges and strategies for risk mitigation. As I listened, I couldn't help but wonder why I never receive such questions when I'm serving as a panelist. I relish these kinds of inquiries, and my response would simply be, "a big nothing."

If you owe the bank $100 that’s your problem. If you owe the bank $100 million that’s the bank’s problem.

J. Paul Getty

And the U.S. owes China close to $800 billion, so it is not the U.S. that should be worried about, it is the Chinese. Recognizing the risks, especially after observing the fate of Russian reserves held in U.S. dollars, China has been cautiously reducing its U.S. treasury holdings. From a high of $1.3 trillion in 2013, China has reduced its stake by approximately $500 billion, opting to purchase fewer treasuries than those reaching maturity. This strategy of reduction has intensified since the Russian invasion of Ukraine, with China accelerating its sell-off.

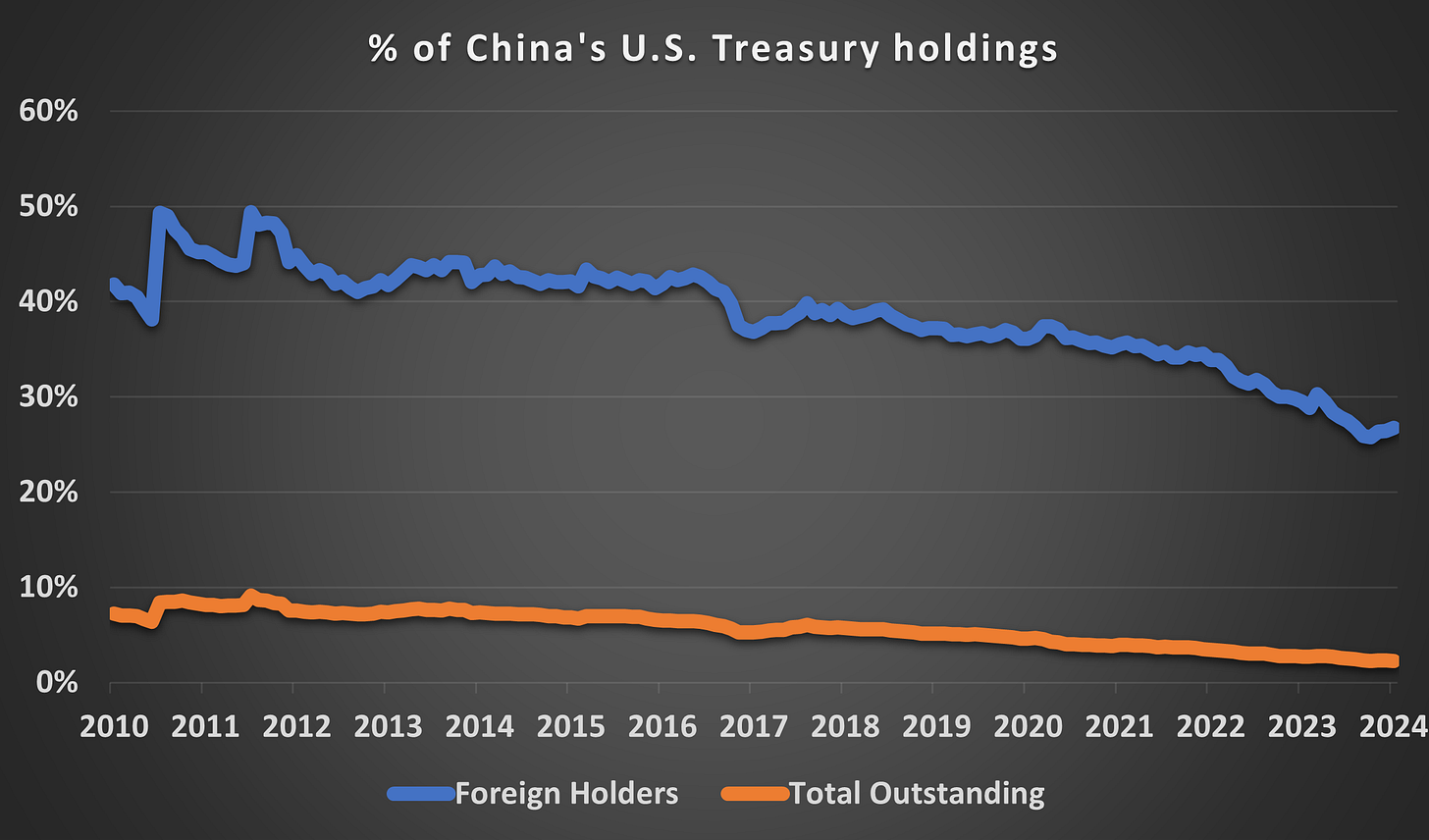

Another perspective on China's stake in U.S. Treasuries highlights a significant shift. In the early 2010s, China accounted for nearly 50% of all U.S. Treasury securities held by foreign entities, a figure that has since fallen to 27%. When considering the entirety of the outstanding U.S. debt, the portion owned by China has dramatically dropped from about 10% to just 2%.

Here is the Federal Reserve’s (FED) Balance sheet. It is not just the Chinese reducing their exposure to U.S. Treasuries, Fed has been doing the same thing. Since the recent peak, Fed’s balance sheet is down $1.3 trillion – most of that reduction came from U.S. Treasury holdings.

So, my short answer to “What happens if China sells all of its U.S. Treasury holdings?” - a big nothing. China has already divested itself of half a trillion dollars in Treasuries. Furthermore, during this period, the Federal Reserve has trimmed its balance sheet by $1.3 trillion, yet the system continues to operate smoothly. Given this trend, China could potentially minimize its holdings without significant impact, eliminating such a query from future panel discussions.

Data Source:

https://fred.stlouisfed.org/