We soft-landed at the wrong airport!

We now have two choices: either re-plane and aim for the correct target or slowly progress towards our main destination if possible.

We soft-landed at the wrong airport! It’s at a higher altitude. Now, we have two choices: either re-plane and aim for the correct airport or taxi slowly to our main destination if possible.

The latest U.S. consumer inflation figures are out, and for a change, they were lower than expected. The previous three months were worse than anticipated.

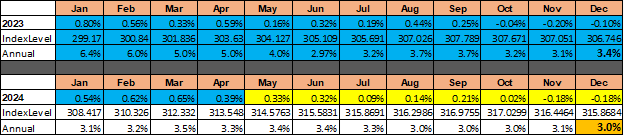

U.S. monthly consumer inflation index (unadjusted)

The unadjusted consumer price index changes are shown above. The highlighted months in yellow show the average monthly changes since 1999. If the rest of the year is average, the year-end inflation is expected to be 3.0%, which might be just enough for the Fed. April benefited from a high base effect from last year, but May, June, and July could be challenging with the risk of headline inflation rising again.

The U.N. Food Inflation

Globally, there are trends that could bring relief in the summer months. According to the U.N. data on global food prices, only oil prices are up by 1% over the last 12 months. Sugar prices have dropped significantly, possibly due to weight loss drugs like Ozempic/Wegovy, down 15%, and the momentum suggests more downside. Cereals are also down 18% year-over-year. The overall food price index increased by only 0.3% in April after a seven-month decline. Meat prices are flat, mainly due to lackluster demand from China.

Inflation in Europe

In Europe, inflation is falling faster than in the U.S., helped by negative producer inflation. Energy and industrial metal prices have returned to pre-Ukraine invasion levels, allowing manufacturers to pass on savings to consumers. The European Central Bank (ECB) and the Bank of England (BoE) are expected to cut policy rates before the Federal Reserve (Fed), potentially leading to additional savings in manufacturing costs.

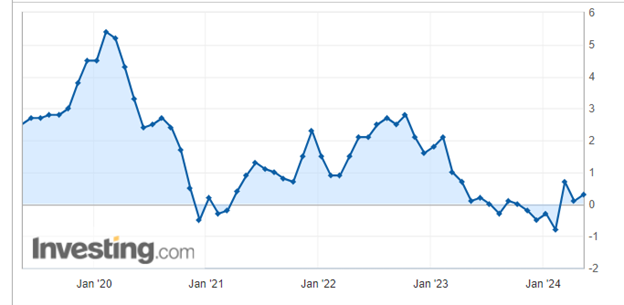

Inflation in China

China presents a unique case with minimal inflation, enabling it to export disinflation globally. This trend may continue due to weak Chinese consumption.

Energy prices

On the energy front, prices are elevated from last year but down from the worst levels of last October or April of this year.

U.S. Rent CPI vs Zillow Rent Index

The U.S. consumer price index includes housing costs using rents, assuming occupants purchase their shelter needs in the private rental market. The Shelter component is significant in the index, with owners' equivalent rent making up about 25% of it. Zillow’s rent index, based on proprietary data, showed rising rents starting in early 2021, earlier than the CPI’s Shelter component. The current Zillow Observed Rent Index is below its recent high, suggesting some room for Shelter inflation to decrease, but not much. Fed Chair Jay Powell also mentioned this in a recent policy press conference.

Bottom Line:

The U.S. economy has experienced inflation settling around 3% without triggering unemployment or an economic slowdown. The key question now is whether monetary authorities will aim for a 2% target, especially in an election year. The inflation readings for May, June, and July will be crucial. Last year, inflation for these months was below historic averages, creating a negative base effect. Any deviation in these upcoming readings could eliminate hopes for rate cuts.

We now have two choices: either re-plane and aim for the correct target or slowly progress towards our main destination if possible. The latter option seems to be the safest—slowly moving towards the correct destination. This implies maintaining higher rates for longer, with the possibility of one or two rate cuts along the way if inflation permits, which is feasible given the global trends favoring lower inflation readings.

Data Sources:

https://www.bls.gov/cpi/

https://news.un.org/en/tags/food-price-index

YCharts for European Inflation and Energy

Investing.com for Chinese inflation

https://en.macromicro.me/charts/49740/us-cpi-rent-zillow-rent-yoy