The first rate cut is the deepest

"I have a particular fondness for the song "The First Cut is the Deepest," penned by Cat Stevens and originally performed by P.P. Arnold. In a fascinating turn of events, Stevens sold the song to Arnold for a mere £30, which then skyrocketed to success for her. For a more immersive experience, I suggest you read this article while listening to some of the different covers of the song suggested at the end of the article – and tell me who you think sang it better."

Currently, global central banks such as the Federal Reserve (Fed), European Central Bank (ECB), Bank of England (BoE), and Bank of Canada (BoC) face a challenging decision on when and by how much to reduce interest rates in 2024. It's anticipated that they will soon begin a series of rate reductions, marking the commencement of a new cycle. The initial rate cut is particularly critical as it signals a major shift in policy and affects the financial conditions for various market stakeholders, notably in the real estate and banking sectors. It's presumed that central bankers engage in deep discussions on inflation trends, labor market conditions, and stresses in the commercial real estate sector, particularly in the U.S., in their private meetings before policy announcements. Thus, the decision on the first-rate cut will delve deep into the economic outlook for their respective economies.

I conducted a poll on LinkedIn among my community to gauge opinions on which central bank might lead in initiating the rate cut cycle. As I expected, most of the 470 votes said that the Fed will lead the way and the others will follow. The Fed has the advantage of not worrying about the effects on the currency markets. The idea is that the Fed will go first and the others will have the green light to do the same. If other central banks go first, like the ECB, that could make the Euro weaker against the U.S. dollar and that could cause more inflation in the Eurozone due to higher costs of goods priced in dollars. This highlights the intricate relationship between rate cuts and foreign exchange market dynamics.

The Fed’s economic projection is one of the most influential one-page document in the global financial markets. The projections, also known as the dot-plot, are updated every other meeting and show the Fed’s outlook for the economy. The projections are based on the views of more than 400 economists who work for the Fed, and are summarized in a small but powerful table, shown below. The table's rightmost column, labeled "Longer run," outlines the Fed's aspirational targets for the economy. These benchmarks are mostly stable, with an ideal unemployment rate at 4.1%, a target Personal Consumption Expenditures (PCE) inflation rate of 2%, and a long-term economic growth expectation of 1.8%. In contrast, the International Monetary Fund (IMF) projects the U.S. economy to expand at a rate of 2.1% in 2024, surpassing the Fed's long-term annual growth expectation. Last year was also a better year for growth than expected and longer run figures.

Here is the source of the above data.

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20231213.pdf

Here is one of the best speeches Jay Powell gave in 2019 about the importance of and the difficulties that comes with the above numbers. It is a must read if you are new to the monetary policy world.

https://www.federalreserve.gov/newsevents/speech/powell20190823a.htm

The Fed also gives a key forecast for the Fed funds rate in the above table – for the long run, it assumes that PCE inflation will be 2%, and the Fed fund rate will be 2.5%, which is 0.5% above inflation. This means that the real interest rates will be only 0.5% higher than inflation in a perfect world.

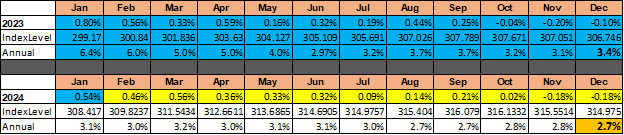

The subsequent table shows the monthly consumer inflation rates in the U.S., both on an annualized basis and as unadjusted indices. The year 2023 concluded with an annual inflation rate of 3.4%, a marked improvement from the previous year's rate of 6.5%. This reduction of 3.1% throughout 2023 represents a significant achievement. However, the inflation data for January 2024, which came in higher than expected, dampened the hopes for a potential rate cut in March. January's inflation was influenced by some anomalies and seasonal fluctuations, notably in the owner's equivalent rent component, which accounts for about one-third of the inflation measure and was unexpectedly high. The inflation data for February is anticipated to offer clearer insight into the trend for the remainder of the year.

he section highlighted in yellow displays the average monthly inflation rates since the beginning of 2000. If we anticipate reverting to these average levels, a 2.7% annual inflation rate is expected for 2024. This implies that the real interest rates are too high, justifying the need for rate cuts. With an assumed real interest rate margin of 0.5%, the current Federal Reserve's target rate for the Fed funds should be 2% lower than its present level. Achieving this would require eight rate cuts to arrive at a 0.5% real interest rate. However, inflation is still above 2% and the trend does not suggest that it will go down to to 2% this year, which requires a higher real interest rate than 0.5%. Even if we increase the real rates to 1.5%, we still need four rate cuts this year to lower the real interest rates.

Inflation can be divided into three components: cost of labor, cost of goods, and cost of capital. The cost of labor is at 4.5% based on the latest payroll data, which is higher than the Fed’s target. The cost of goods is falling, as global producer prices indicate lower inflation in the future. The cost of capital has increased significantly due to the fastest rate hike cycle in recent memory. Initiating a cycle of rate reductions could further suppress inflation, fostering a beneficial cycle. There are also global trends that support lower inflation in the U.S. Inflation in Europe is declining, China’s consumer and producer prices are negative, the U.N. food price index is 25% lower than its peak, and energy and industrial commodities are on a downward trend.

The world’s central banks will have a busy month of March, discussing the possibility of their first rate cut, examining the deep aspects of the economic activity for potential inflation trends and pressures that have accumulated in many sectors like the commercial real estate and the banks. The current real interest rate is too tight, four rate cuts are needed and two more are possible if inflation can follow a lower path – a path that could lead to below 2.5% yearly inflation.

"The first cut is the deepest"

By Rod Stewart (my favorite)

By Sheryl Crow

By Cat Sevens (song writer)

By P.P. Arnold (first released in 1967)