According to the latest state-level data from the Bureau of Economic Analysis (BEA), seven U.S. states outpaced China’s economic growth rate in 2023, the Magnificent 7. These states, which achieved growth rates exceeding 5%, include Alaska, Texas, Florida, Oklahoma, Nebraska, Wyoming, and North Dakota. Remarkably, not only did they surpass China’s growth rate last year, but they also outpaced many emerging market economies. In a fascinating trend, Antoine van Agtmael, the founding father of Emerging Markets investment category, had already predicted this phenomenon back in 2016. His book, co-authored with Fred Bakker, titled “The Smartest Places on Earth: Why Rustbelts Are the Emerging Hotspots of Global Innovation”, delves into how seemingly unlikely regions—such as rustbelt cities like Akron and Albany in the United States and Eindhoven in Europe—are becoming hubs of global innovation. These areas prioritize brainpower-sharing and creating smarter products, rather than merely focusing on cost-effectiveness. The book provides an intriguing perspective on how these regions are turning globalization on its head.

If you’re curious, you can explore this insightful read by following the below link to the book: The Smartest Places on Earth.

According to the BEA’s most recent data, other than the Magnificent 7, several other states experienced robust economic growth. Notably, Washington, Kansas, and West Virginia achieved growth rates close to 5%. Impressively, out of the 50 states, 49 exhibited positive economic growth rates. The sole exception was the state of Delaware, which reported a negative growth rate.

Across most states, personal income growth rates exceeded 5%. Notably, Floridians led the way with an impressive 7% growth rate, which is more than twice the lowest growth rate observed in Indiana at 3.4%.

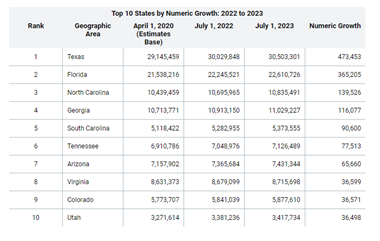

Based on recent data from the U.S. Census Bureau, population growth has played a significant role in driving faster economic growth rates in certain states. Notably, both Texas and Florida experienced substantial population increases in terms of numeric values.

Source: Census Bureau

Let’s delve into the same data from a percentage perspective. The intriguing aspect here lies in the disparity between Delaware’s population growth—ranking 6th best in the country at 1.2%—and its GDP growth rate, which unfortunately recorded a negative value. According to the BEA report, the primary culprit behind this GDP decline is the Finance & Insurance sector.

Source: Census Bureau

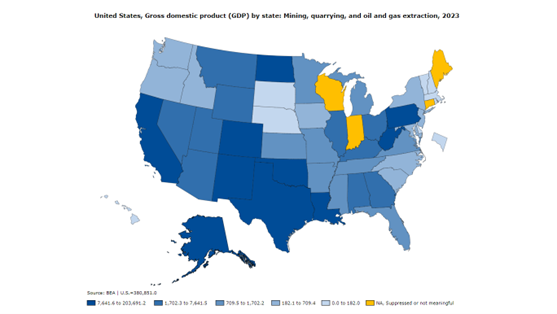

Mining quarrying, and oil and gas extraction is an important source of economic activity for many states that experienced higher economic growth rates. Here are the top 10 states sorted by mining in $ million terms.

Source: BEA

Here is the full data for all states.

Emerging Market stocks, particularly those from China, have been a topic of vigorous debate in financial markets. Their relative underperformance compared to U.S. markets has prompted various explanations.

Let’s delve into the key factors contributing to this divergence:

Xi Jinping’s “Thought on Socialism with Chinese Characteristics for a New Era”: This ideological framework, while shaping China’s economic policies, has inadvertently constrained private enterprise by imposing restrictions on resource allocation.

State-Owned Entities (SOEs): These entities, rather than prioritizing investor profits, often serve as tools for influencing local politics and economics. Their impact on market dynamics can hinder efficient resource utilization.

Geopolitical Winds of Change: The risk premium applied to overseas emerging markets has increased due to shifting geopolitical dynamics. Investors perceive higher uncertainty and potential volatility in these regions.

Strong U.S. Dollar: The robustness of the U.S. dollar affects capital flows. When the dollar is strong, it can create headwinds for emerging markets by making their debt more expensive and affecting trade balances.

The Phenomenal Returns of the “Magnificent 7” Stocks: Companies like Nvidia, Meta, Amazon, Microsoft, Alphabet, Apple, and Tesla have delivered exceptional returns. Their success isn’t limited to emerging markets; even developed markets outside the U.S. struggle to match their performance.

The Performance of the Magnificent 7 States: Beyond individual stocks, consider the economic prowess of certain U.S. states. These “Magnificent 7 States” contribute significantly to the nation’s overall strength.

U.S. Economy and Innovation: The U.S. economy’s dominance in the global financial system is expected to be further bolstered by continued innovation, particularly in artificial intelligence (AI).

Supportive Institutional Environment: Institutions in the U.S. provide a favorable backdrop for economic growth. Factors such as clear separation of power, strong intellectual property rights, relatively independent monetary policy, and fair elections enhance maneuverability.

Intellectual Property Rights and Innovation: Strong intellectual property rights are crucial for fostering innovation. The U.S. legal system allows ideas to flourish, driving progress across various sectors.

Inclusivity and Resource Utilization: The U.S. is an inclusive society, leveraging maximum human resources and seemingly limitless capital to fuel growth and productivity.

In summary, the exceptional attributes of the U.S.—from its innovative ecosystem to its robust institutions—make it a unique player on the global stage. No other country can offer this combination of strengths at such a scale

Sources:

https://www.bea.gov/sites/default/files/2024-03/stgdppi4q23-a2023-fax-annual.pdf

Book recommendation: