6 rate cuts vs 4 rate cuts... and the winner is...

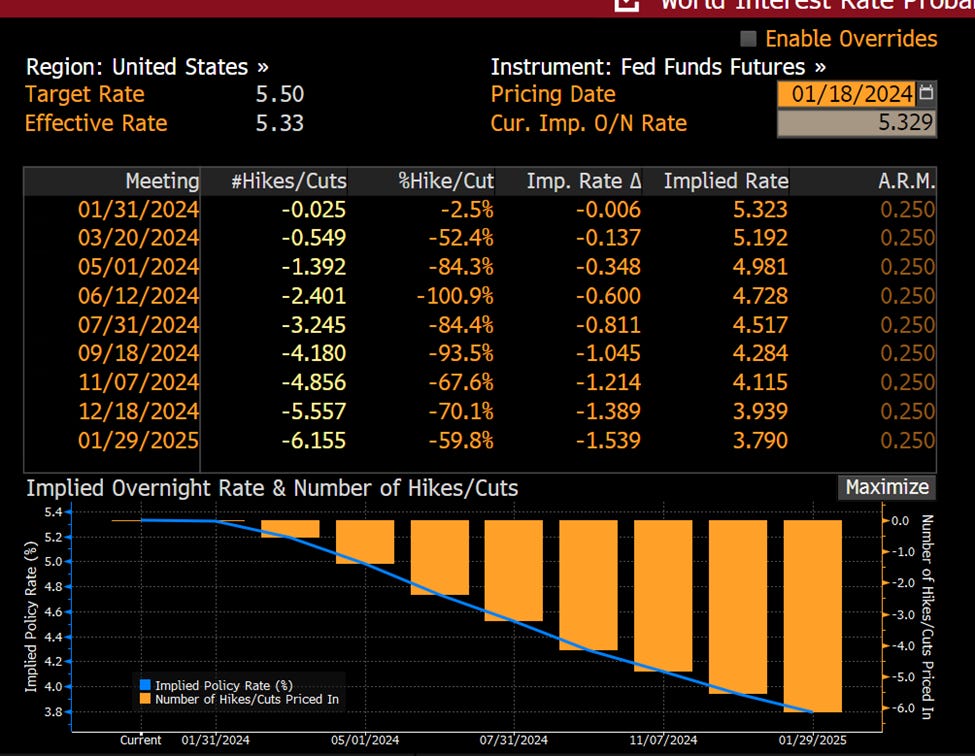

Market discussions are centered around the number of Federal Reserve rate cuts expected in 2024. While the market is leaning towards six cuts, the Federal Reserve's dot-plot indicates only four.

Market discussions are actively centered around the number of Federal Reserve rate cuts expected in 2024. While the market is leaning towards six cuts, the Federal Reserve's dot-plot indicates a possibility of just four. This disparity has led to notable disagreements among market analysts, particularly those featured on Bloomberg TV and CNBC, with many anticipating a lower number of cuts than what market pricing currently suggests. My perspective aligns with the market's expectation, believing that six rate cuts are the most probable scenario.

Here are couple reasons for it:

First, here is where the six-rate cut story is coming from. Based on market pricing displayed on Bloomberg terminal the first cut may happen in March with a 52% probability and in total we could have six cuts in 2024.

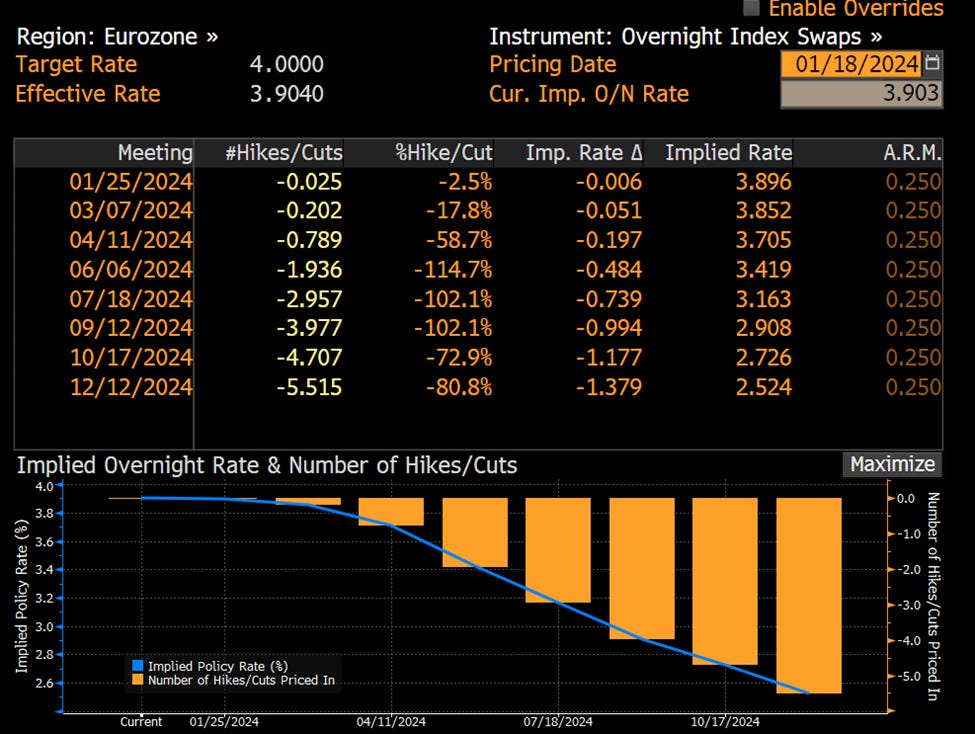

Here is the same picture for ECB – also six cuts with the first one coming in April, 58% probability

Lastly BoE – only 4 cuts with the first in May with a much lower probability

The Federal Reserve's latest economic forecasts were released in December 2023, with the next update expected in March. As per the December projections, the Fed anticipated approximately four rate cuts, potentially reducing the Federal Funds rate to around 4.6%. A key indicator of future rate levels is found in the long-term projections. Ideally, the Fed aims for a Personal Consumption Expenditures (PCE) inflation rate of 2% and corresponding rates of 2.5%, implying a preferred real rate of just 0.5%. Therefore, inflation's trajectory is pivotal – understanding where inflation is headed will help in predicting the Fed's policy rate direction.

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20231213.pdf

Here is the inflation path of 2023 and the row highlighted in yellow projects the inflation’s trajectory for 2024, based on trends observed over the past 23 years since 2000. This projection suggests a promising start to 2024, with a sharp decline in annual inflation potentially leading to the Federal Reserve's first interest rate cut in March. The forecast for the remainder of the year is less certain, with fluctuations expected until the July inflation figures are released. By December's end, annual inflation could reduce to 2.5%, enabling the Federal Reserve to adjust rates six times throughout the year while maintaining positive real rates. In this scenario, the upper bound of Fed target rates ends at 4% leaving real rates around 1.5% which is still restrictive according to Fed’s long-run projections of a 0.5% real rate.

Deflationary trends are global, here is the UN’s price index for food and agriculture in the world. From the peak of March-22 prices are down 25% on average and the trend is still supportive of lower inflation readings.

I concur with the market's expectation of six rate cuts in 2024 being the most probable scenario. Inflation remains a crucial factor to monitor. Additionally, the labor market dynamics are significant, especially considering the labor shortages in many countries. Notably, in the U.S., labor participation is trending positively, bringing more workers into the workforce. Lower interest rates result in a reduced cost of capital, which, in turn, can decrease future inflation – this creates a beneficial cycle that could lead to unexpectedly lower than anticipated inflation figures.

It is commonly understood that the Federal Reserve typically strives to distance itself from political influences. However, in a crucial election year like this one, staying completely neutral may be challenging. Consequently, I also believe that the Fed might be inclined to implement more rate cuts rather than maintaining a status quo.

Let’s see what happens…